77

Dylan Morris; Emily Mills; and Whitney Causey

For our final project, we decided to do a PowerPoint over managing money and different budgeting strategies.We chose this topic because managing money as a college student is vital. We interviewed students around campus to see if they manage their money and if they have a budgeting plan set into place.

Personal Relation

Emily Mills- ”I really struggle with managing my money. I don’t have a budget plan set into place, but I would like to have one. I spend my money on both wants and needs, but usually wants. I have a dollar left of Bear Bucks.”

Whitney Causey- ”I do not really struggle with my money. My budget plan is, I only spend $100 a week. I only buy my needs, but sometimes wants.”

Dylan Morris- ”I don’t struggle too bad with my money, but I do not have a budgeting plan like many college students. I currently have $3 left in Bear bucks.”

Survey Questions

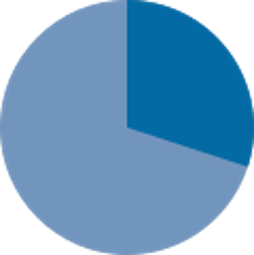

1. Do you currently have a budgeting plan set in place?

71% Yes/29% No

Many students say that they have a mobile banking app and that is how they keep track of their money.

Those who did have a plan elaborated on it and some results were that they only spend a certain amount of money a week, no matter what.

Needs- 14%

Wants- 29%

Equal Both- 57%

0-50: 50%

50-100: 25%

100-150: 8%

+150: 17%

Yes- 73%

No- 27%

- Make a schedule

- Track your money (online banking account)

- Cut up your credit cards

- Think before you buy

- Plan your needs first

- Keep a portion of your paycheck back when you get paid

- Avoid depression, it makes you spend money

- Reward yourself sometimes

How to Make a Budgeting Plan

- See how much money you have

- Put a money limit on your wants

- Put your needs before wants

- Make arrangements for paying bills

- Plan ahead so you’re not in debt

- Keep track of how much money you actually have

Cruze, R. (2019, September 9). 15 Practical Budgeting Tips. Retrieved from https://www.daveramsey.com/blog/the-truth-about-budgeting.

5 Simple Steps to Create a Successful Budget. (2018, April 17). Retrieved from https://www.payoff.com/life/money/5-simple-steps-to-create-a-successful-budget/.

Bieber, C. (2018, April 21). Budgeting 101: How to Start Budgeting for the First Time. Retrieved from https://www.fool.com/investing/2018/04/21/budgeting-101-how-to-start-budgeting-for-the-first.aspx.

Vohwinkle, J. (2019, November 20). Helpful Tips to Budget Your Finances. Retrieved from https://www.thebalance.com/budgeting-101-1289589.