4.5 Structural Issues of Houselessness

Let’s consider how, for many communities, housing insecurity is a legacy of historic patterns of removal, exclusion and descrimination that have specifically targeted Native Americans, African Americans, and LGBTQIA+ families.

4.5.1 A Historic Legacy

In Multnomah County, Oregon, native people make up 2.5 % of the population but 10% of people who are unhoused (Schmid 2017). Native Americans have the highest poverty rate of any racial-ethnic group (28% in 2015 according to the U.S. Census). The control the government has exerted over their living conditions likely contributes to this circumstanceWhen the U.S. government forcibly removed Native Americans to reservation lands, it also retained ownership of that land. The government holds reservation lands “in trust” for the tribal nations. Trusts are financial arrangements that allow a third party trustee to hold and control assets on behalf of a beneficiary. The underlying justification for most trusts is that the beneficiaries can not be trusted to properly manage their assets. While this might be acceptable for minor children who inherit large sums of money, this paternalistic oversight of Native American people perpetuates systems of displacement and genocide that have been visited upon indigenous people in the Americas for 600 years.

While there is much public debate about other aspects of tribal rights such as casinos and the effects of using stereotypical Native or Indian images and names for sports teams, there is little recognition among non-tribal members of the ways the U.S. government has limited home ownership for Native Americans (Schaefer Riley 2016). For example, Native Americans who fought alongside White G.I. ‘s in World War II have been denied the opportunity to create the same generational wealth as other American Veterans. Because reservation land is held in trust, the returning Native American veterans were excluded from the G.I. Bill home loans for homes on reservation land. This is one of several discriminatory policies that racialized home ownership in the mid-20th Century. Let’s look at the discriminatory lending and zoning practices to learn more.

4.5.2 Creating Under-resourced Communities: Racism, Segregation, Redlining.

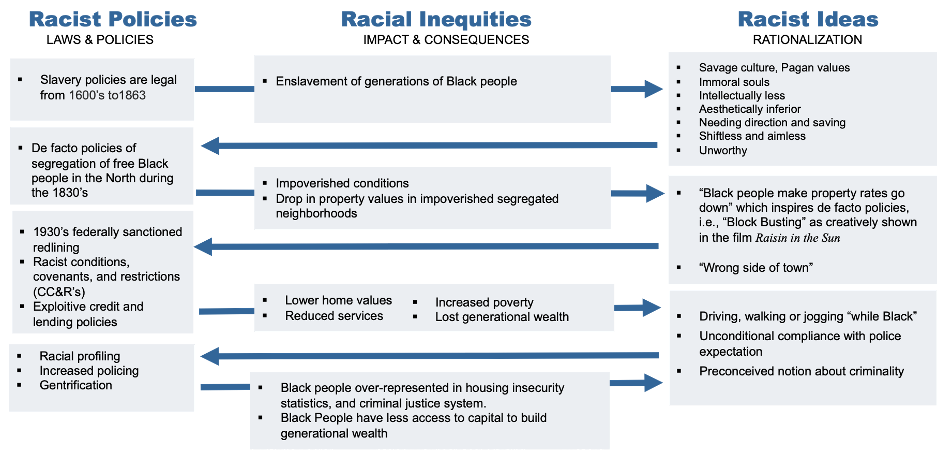

Figure 4.11 Segregated neighborhoods did not come about organically, but through deliberate planning of policies and practices.

To understand the roots of racially segregated housing policies, we need to start with enslavement and the racist ideas that justified it. Recall from Section 4 that Ibram X. Kendi asserts that any policies that result in racial inequity and ideas that justify or excuse racial inequity are racist. Racist ideas about the supposed inferiority of people who are Black include ideas about “degeneracy”, cleanliness, laziness, sexual habits, drug use, and dishonesty. Even though slavery was illegal in northern states, people in nothern cities were still taught that people who were Black were different from, and inferior to White people.

As early as 1830, free Black people who made their way to northern cities were not welcome in many communities. Poor people who were Black lived in racially segregated housing. Often, they had to move when developers landowners found more profitable uses for the land. Even affluent and educated Black people who had the resources to buy property experienced displacement and descrimination.

For example in 1850, Seneca Village, a thriving black community of 1600 people outside of New York City, was displaced by eminent domain to build Central Park. The community boasted successful businesses, a vibrant church and a school. Harper’s and other magazines, however, relied on racist ideas and racial epithets (like the n-word) to describe the community as a decrepit shantytown. They also claimed the residents were unable to properly care for the valuable real estate they held. Residents who owned the land were compensated, but the land was undervalued. This land grab was conveniently justified by the emergence of the powerful racist idea that property values go down where black people live.

Between 1910 and 1970, in a period called the Great Migration, more that 6 million people who were Black relocated from the rural south to cities in the north and west in search of better jobs. Many people in the north accepted the same racist ideas that fueled the brutal racism of the south. As in New York, a century before, many White people and European immigrants feared that black people would lower property values.

During the postwar housing boom of the 40’s and 50’s, the G.I. Bill provided low-interest home loans to returning most veterans. New suburban communities sprang up.The American dream of home ownership became a reality across the U.S. Because many Americans believed that the presence of Black people in a neighborhood lowered property values, Black families were routinely denied loans for the new suburban homes. They were forced to buy houses in older, more urban communities, like the Albina neighborhood in Portland, Oregon.

Once Black families bought homes in urban neighborhoods, real estate agents routinely took advantage white homeowners’ fears of lower property values, to persuade them to sell their property at a low price. The agents then turned a profit reselling them to Black families at higher prices. Lenders charged them higher interest rates. Realtors and lenders made big profits off of this practice, called “block-busting”. They also succeeded in lowering the value of homes in rapidly segregated neighborhoods. Since these homes were assessed at low value, the tax base of these neighborhoods was restricted.Tax funded infrastructure, like public works and schools, was underfunded. In other words it was not the presence of Black people, but the prejudice of White homeowners, grounded in racist ideas, that led to lower property values, and created under-resourced communities.

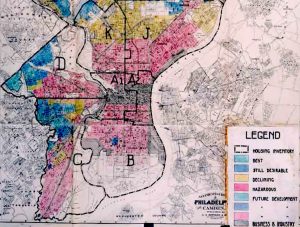

Figure 4.12. Lending institutions and the federal government created maps in which the places where people of color and/or foreign-born lived were colored red and designated to be “dangerous” or “risky”.

Redlining is the discriminatory practice of refusing loans to creditworthy applicants in neighborhoods that banks deem undesirable. Both the federal government, which created the Home Owners’ Loan Corporation in 1933 and the Federal Housing Association (FHA) in 1934, along with the real estate industry, worked to segregate Whites from other groups in order to preserve property values in neighborhoods where White people lived.

Lending institutions and the federal government did this by creating maps in which the places where people of color and/or immigrants lived were colored red. This practice became known as redlining, the discriminatory practice of refusing loans to creditworthy applicants in neighborhoods that banks deem undesirable or racially occupied. Then those areas were designated to be “dangerous” or “risky” in terms of loaning practices.

In 1968, these practices were outlawed by the Fair Housing Act, which was part of the Civil Rights Act. The Fair Housing Act is an attempt at providing equitable housing to all. It makes it illegal to discriminate against someone based on skin color, sex, religion, and disability. Also banned is the practice of real estate lowballing, where banks underestimate the value of a home. This practice forces a borrower to come up with a larger down payment to compensate for the lower loan value. The offering of higher interest rates, insurance, and terms and conditions to people from historically underrepresented groups is illegal. Denying loans and services on the basis of an applicant’s protected class is also illegal.

Still, much damage was done prior to its passage. For decades, the federal government poured money into home loans that almost exclusively favored White families. Homeownership is the most accessible way to build equity and wealth. It was denied to many historically marginalized families for decades. Once the Fair Housing Act passed, local governments used other legal methods to justify to racist real estate practices well into the 2000s.

|

|

Figure 4.13 Racist Policies, Racist Inequities, and Racist Ideas in Housing: This chart illustrates Ibram X Kendi’s definition of racism as “…a marriage of racist policies and racist ideas that produce and sustain racial inequities” (2016). Notice the connections between racist policies in housing, racial inequities and racist ideas. We can say that the entire system is racist because each of the components reinforces the other and leads to even more racial inequity. Figure 4.13 mage Description

Today, in spite of repeated efforts by city officials to create more mixed race and mixed income neighborhoods, Portland’s neighborhoods have remained demographically segregated. Gentrification and redevelopment have reduced the available inventory of affordable housing. Portland’s land use planning history has continued to benefit White homeowners while communities of color have been burdened, excluded, and disproportionately vulnerable to housing insecurity.

4.5.3 Climate-related displacement

As we look at climate displacement worldwide, we see that more people become houseless due to natural disasters than due to conflict or violence. Climigration is the act of people relocating to areas less devastated by flooding, storms, drought, lack of clean water, or economic disaster due to the forces of climate change. Many American families relocate as jobs disappear or land becomes flooded or arid. In response to immediate disaster, many families move to live with relatives or friends. Some families have nowhere to turn.

In response to the increased risks of property loss as oceans warm and sea level rises, lending institutions are beginning to practice bluelining, which designates real estate that is considered high risk due to low elevation may not qualify for loans. We’ll explore more social impacts of climate change in Chapter 5.

Figure 4.13 Oregon Already Has a Climate Refugee Crisis [YouTube Video]

In Chapter 11 we will look at the impacts of the Echo Mountain, which destroyed 288 homes and 339 structures in Lincoln County, Oregon. Climate driven wildfires in 2020 burned over a million acres and displaced 10% of Oregon’s population. In southern Oregon, where affordable housing was already limited, low income renters have been left with few options. As of 2022, more than 500 survivors of the 2020 wildfires were living in shelters. Please watch the 6:39 minutes video in figure 4.13 to see how climate-related housing insecurity is impacting survivors of the Jackson County Fires.

4.5.4 Structural Issues of Houslessness Licenses and Attributions

“Structural Issues of Houselessness” by Nora Karena is licensed under CC BY 4.0.

Elizabeth Pearce Contemporary Families: An Equity Lens. licensed under CC-BY-4.0 Indigenous People and Reservation Land: Edited and updated for context.

Redlining and Bluelining: Edited for context

From Fair Housing Act: edited and updated for context.

Figure 4.11 “Sign: ‘We Want White Tenants in our White Community‘” by Arthur Siegel / Office of War Information by Arthur Seigel is in the Public domain.

Figure 4.12 Home Owners’ Loan Corporation Philadelphia redlining map Public domain, via Wikimedia Commons public domain.

Figure 4.13 Racist Policies, Racist Inequities, and Racist Ideas in Housing: Nora Karena, Michelle Osborne, Toni Belcher. License: CC BY 4.0.

Figure 4.14 Video: Oregon Already Has a Climate Refugee Crisis. ©Vice News. License Terms: Standard YouTube License.