The Loanable Funds Market

Learning Objectives

By the end of this section, you will be able to:

- Explain how the loanable funds market models the financial sector

- Explain how the orthodox economists understand thrift to be an important source for economic growth

As you learned earlier in the chapter, orthodox economists believe that, at least in the long run, capitalist economies should naturally tend toward full employment through adjustments in prices (including wages). However, there is one potential problem: what happens when the households that participated in creating the output (as workers, landlords, capitalists, and so on), decide not to use their income to purchase that output? That is, what happens when income is saved?

The solution to this problem in the orthodox framework is an additional type of factor market: the loanable funds market. Through this market, household savings are channelled into business loans for investment. As a result, any income not spent (that is, saved) becomes investment, which of course is a type of spending. All of this is the really just another way of ensuring that in this model Say’s Law holds: supply creates its own demand, and if there is less supply than is possible (at full employment), or insufficient demand to purchase that supply, then price adjustments will correct the imbalances.

The Loanable Funds Market

In the loanable funds market, the price is the interest rate and the thing being exchanged is money. Households act as suppliers of money though saving, and they will supply a large quantity of money (that is, they will save more) as the interest rate increases. This should be intuitive: the interest rate is the return (or reward) you earn for saving your money; the higher the interest rate, the more inclined you will be to save.

Businesses, in turn, are the demanders in loanable funds market. Here, businesses are borrowing the money households save so that they can make real investments–for instance, buying a new fleet of delivery vans or upgrading the office computers’ software. As is the usual case, demand declines with price. For the loanable funds market, this means that, the lower the interest rate, the greater the amount of money businesses will want to borrow, since the interest rate is the cost of taking out the loan.

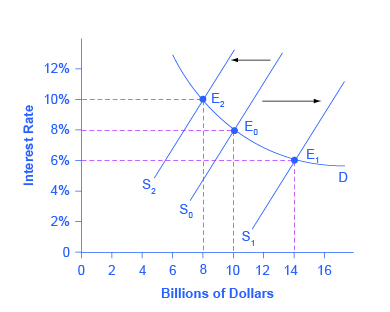

Looking to the figure below, we can see that, when the supply of loanable funds is at S0, the equilibrium (E0) occurs at an 8% interest rate and a quantity of funds loaned and borrowed of $10 billion. This suggests that, at an 8% interest rate, households will be saving a total of $10 billion. By definition, this means that households aren’t spending $10 billion of their income, which is a problem for Say’s Law: output is $10 billion higher than household spending. But, of course, at an 8% interest rate, businesses will be borrowing $10 billions and, most importantly, spending that money on real investment.

Hence, the problem of saving is solved: so long as the interest rate adjusts to equilibrium in the loanable funds market, any income not spent (that is, money saved) will ultimately become spending through investment. In a sense, this is an extension of Say’s Law: supply creates its own demand, but money saved is supply (production) that created income that didn’t create demand (spending). Not to worry, though, because saving in the orthodox framework is its own kind of supply (to the loanable funds market), which becomes spending just the same.

The Power of Thrift

The loanable funds market isn’t just a clever solution to the problem of saving and Say’s Law, it’s the basic way that orthodox economists understand the financial sector in general. While you’ll learn more about the complexity of the financial sector and how economists understand it in later chapters, it is worth looking at one important conclusion derived from the loanable funds model. Namely, this framework suggests that saving is the fundamental engine for economic growth.

The importance of saving for growth will be clear once we recognize that investment, in machines, research & development, software upgrades, and so on, is what increases productivity, which in turn is what spurs growth in general. And, since in the loanable funds market, investment is financed through loans which are funded with households’ savings, then it makes sense to see saving as the ultimate source of economic growth.

We can see this process working in the graph above. An increase in the thriftiness–that is, the desire to save–among households will shift the supply of loanable funds to the right from the original supply curve (S0) to S1. This will lead to an equilibrium (E1) with a lower 6% interest rate and a quantity $14 billion in loaned funds. At this lower interest rate, the cost of borrowing for investment is lower, which means more businesses will be willing to make greater investments.

Conversely, if households desire to save less and spend more of their income, moving the loanable funds supply curve, say, from S0 to S2. the result would be a higher interest rate, leading to lower levels of investment. In this scenario, households are enjoying more of the fruits of their labor today, through current consumption, but at the expense of investing in productivity growth for the future.