2.5 – Confronting Objections to the Orthodox Economic Approach

Learning Objectives

- Analyze arguments against orthodox economic approaches to decision-making

- Interpret a tradeoff diagram

- Contrast normative statements and positive statements

It is one thing to understand the orthodox economic approach to decision-making and another thing to feel comfortable applying it. The sources of discomfort typically fall into two categories: that people do not act in the way that fits the economic way of thinking, and that even if people did act that way, they should try not to. Let’s consider these arguments in turn.

First Objection: People, Firms, and Society Do Not Act Like This

The orthodox economic approach to decision-making seems to require more information than most individuals possess and more careful decision-making than most individuals actually display. After all, do you or any of your friends draw a budget constraint and mutter to yourself about maximizing utility before you head to the shopping mall? Do members of the U.S. Congress contemplate production possibilities frontiers before they vote on the annual budget? The messy ways in which people and societies operate somehow doesn’t look much like neat budget constraints or smoothly curving production possibilities frontiers.

However, the orthodox economic approach can be a useful way to analyze the tradeoffs of certain economic decisions. To appreciate this point, imagine for a moment that you are playing basketball, dribbling to the right, and throwing a bounce-pass to the left to a teammate who is running toward the basket. A physicist or engineer could work out the correct speed and trajectory for the pass, given the different movements involved and the weight and bounciness of the ball. But when you are playing basketball, you do not perform any of these calculations. You just pass the ball, and if you are a good player, you will do so with high accuracy. Indeed, if you were a professional player, the competition you engaged in to get to that level almost certainly ensured that high level of skill.

At the same time, the fact that a good player can throw the ball accurately because of practice and skill, without making a physics calculation, does not mean that the physics calculation is wrong.

Similarly, from an orthodox economic point of view, someone who goes shopping for groceries every week has a great deal of practice with how to purchase the combination of goods that will provide that person with utility, even if the shopper does not phrase decisions in terms of a budget constraint. So, when thinking about economic actions it is reasonable as a first approximation, to analyze them with the tools of orthodox economic analysis.

Second Objection: People, Firms, and Society Should Not Act This Way

The orthodox economic approach portrays people as acquisitively self-interested. For some critics of this approach, even if acquisitive self-interest is sometimes an accurate description of how people behave, these behaviors are frequently not moral. Instead, the critics argue people are often taught, and will often behave, in a way that cares more deeply about others. Orthodox economists offer several answers to these concerns.

Orthodox economics is not a form of moral instruction. Rather, it seeks to describe a type of economic behavior that it believes exists. Philosophers draw a distinction between positive statements, which attempt to describe the world objectively, and normative statements, which describe the world subjectively. For example, an orthodox economist could analyze a proposed subway system in a certain city. If the expected benefits exceed the costs, he concludes that the project is worth doing—an example of positive analysis. Another economist argues for extended unemployment compensation during the Great Depression because a rich country like the United States should take care of its less fortunate citizens—an example of normative analysis.

Even if the line between positive and normative statements is not always crystal clear, orthodox economic analysis does try to remain rooted in the study of the actual people who inhabit the actual economy. Fortunately, however, the assumption that individuals are purely self-interested is a simplification about human nature. In fact, we need to look no further than to Adam Smith, the very father of economics, to find evidence of this. The opening sentence of his book, The Theory of Moral Sentiments, puts it very clearly: “How selfish soever man may be supposed, there are evidently some principles in his nature, which interest him in the fortune of others, and render their happiness necessary to him, though he derives nothing from it except the pleasure of seeing it.” Clearly, individuals are malleable, sometimes exhibiting self-interested traits and sometimes exhibiting more altruistic traits focused on others.

Is a diagram by any other name the same?

When you study economics, you may feel buried under an avalanche of diagrams: diagrams in the text, diagrams in the lectures, diagrams in the problems, and diagrams on exams. Your goal should be to recognize the common underlying logic and pattern of the diagrams, not to memorize each of the individual diagrams.

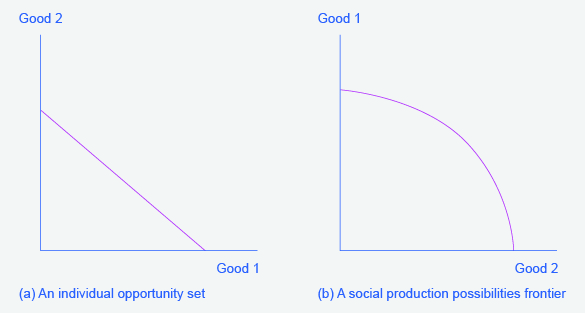

This chapter uses only one basic diagram, although it is presented with different sets of labels. The consumption budget constraint and the production possibilities frontier for society, as a whole, are the same basic diagram. Figure 1 shows an individual budget constraint and a production possibilities frontier for two goods, Good 1 and Good 2. The tradeoff diagram always illustrates three basic themes: scarcity, tradeoffs, and economic efficiency.

The first theme is scarcity. It is not feasible to have unlimited amounts of both goods. But even if the budget constraint or a PPF shifts, scarcity remains—just at a different level. The second theme is tradeoffs. As depicted in the budget constraint or the production possibilities frontier, it is necessary to give up some of one good to gain more of the other good. The details of this tradeoff vary. In a budget constraint, the tradeoff is determined by the relative prices of the goods: that is, the relative price of two goods in the consumption choice budget constraint. These tradeoffs appear as a straight line. However, the tradeoffs in many production possibilities frontiers are represented by a curved line because the law of diminishing returns holds that as resources are added to an area, the marginal gains tend to diminish. Regardless of the specific shape, tradeoffs remain.

The third theme is economic efficiency, or getting the most benefit from scarce resources. All choices on the production possibilities frontier show productive efficiency because in such cases, there is no way to increase the quantity of one good without decreasing the quantity of the other. Similarly, when an individual makes a choice along a budget constraint, there is no way to increase the quantity of one good without decreasing the quantity of the other. The choice on a production possibilities set that is socially preferred, or the choice on an individual’s budget constraint that is personally preferred, will display allocative efficiency.

The basic budget constraint/production possibilities frontier diagram will recur throughout this book. Some examples include using these tradeoff diagrams to analyze trade, labor supply versus leisure, saving versus consumption, environmental protection and economic output, equality of incomes and economic output, and the macroeconomic tradeoff between consumption and investment. Do not be confused by the different labels. The budget constraint/production possibilities frontier diagram is always just a tool for thinking carefully about scarcity, tradeoffs, and efficiency in a particular situation.

Third, self-interested acquisitive behavior can potentially lead to positive social results. For example, when people work hard to make a living, they create economic output. Consumers who are looking for the best deals will encourage businesses to offer goods and services that meet their needs. Adam Smith, writing in The Wealth of Nations, christened this property the invisible hand. In describing how consumers and producers interact in a market economy, Smith wrote:

Every individual…generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain. And he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention…By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it.

The metaphor of the invisible hand suggests the possibility that broader social good can emerge from selfish individual actions.

Fourth, even people who focus on their own acquisitive self-interest in the economic part of their life often set aside their own narrow self-interest in other parts of life. For example, you might focus on your own self-interest when asking your employer for a raise or negotiating to buy a car. But then you might turn around and focus on other people when you volunteer to read stories at the local library, help a friend move to a new apartment, or donate money to a charity. While not ubiquitous, acquisitive self-interest is the orthodox economic starting point for analyzing many economic decisions.

Choices … To What Degree?

What have we learned? We know that scarcity impacts all the choices we make. So, an orthodox economist might argue that people do not go on to get bachelor’s degrees or master’s degrees because they do not have the resources to make those choices or because their incomes are too low and/or the price of these degrees is too high. A bachelor’s degree or a master’s degree may not be available in their opportunity set.

The price of these degrees may be too high not only because the actual price, college tuition (and perhaps room and board), is too high. An orthodox economist might also say that for many people, the full opportunity cost of a bachelor’s degree or a master’s degree is too high. For these people, they are unwilling or unable to make the tradeoff of giving up years of working, and earning an income, to earn a degree.

Finally, the statistics introduced at the start of the chapter reveal information about intertemporal choices. An orthodox economist might say that people choose not to get a college degree because they may have to borrow money to go to college, and the interest they have to pay on that loan in the future will affect their decisions today. Also, it could be that some people have a preference for current consumption over future consumption, so they choose to work now at a lower salary and consume now, rather than putting that consumption off until after they graduate college.

Summary

The orthodox economic way of thinking is one approach to understanding human economic interactions. Orthodox economists attempt to make a distinction between positive statements, which are objective, and normative statements, which are subjective. Furthermore, they argue that people and organizations may not actually behave precisely the way the models suggest, but we can still analyze them as behaving as if their thinking conformed with the theory.

References

Smith, Adam. “Of Restraints upon the Importation from Foreign Countries.” In The Wealth of Nations. London: Methuen & Co., 1904, first pub 1776), I.V. 2.9.

Smith, Adam. “Of the Propriety of Action.” In The Theory of Moral Sentiments. London: A. Millar, 1759, 1.

Glossary

- invisible hand

- idea that self-interested behavior by individuals can lead to positive social outcomes

- normative statement

- statement which describes how the world should be

- positive statement

- statement which describes the world as it is

statement which describes the world as it is

statement which describes how the world should be

when human wants for goods and services exceed the available supply

idea that self-interested behavior by individuals can lead to positive social outcomes