15.2 – Government Spending

Learning Objectives

By the end of this section, you will be able to:

- Identify U.S. budget deficit and surplus trends over the past five decades

- Explain the differences between the U.S. federal budget, and state and local budgets

Government spending covers a range of services that the federal, state, and local governments provide. When the federal government spends more money than it receives in taxes in a given year, it runs a budget deficit. Conversely, when the government receives more money in taxes than it spends in a year, it runs a budget surplus. If government spending and taxes are equal, it has a balanced budget. For example, in 2009, the U.S. government experienced its largest budget deficit ever, as the federal government spent $1.4 trillion more than it collected in taxes. This deficit was about 10% of the size of the U.S. GDP in 2009, making it by far the largest budget deficit relative to GDP since the mammoth borrowing the government used to finance World War II.

This section presents an overview of government spending in the United States.

Total U.S. Government Spending

Federal spending in nominal dollars (that is, dollars not adjusted for inflation) has grown by a multiple of more than 38 over the last four decades, from $93.4 billion in 1960 to $3.9 trillion in 2014. Comparing spending over time in nominal dollars is misleading because it does not take into account inflation or growth in population and the real economy. A more useful method of comparison is to examine government spending as a percent of GDP over time.

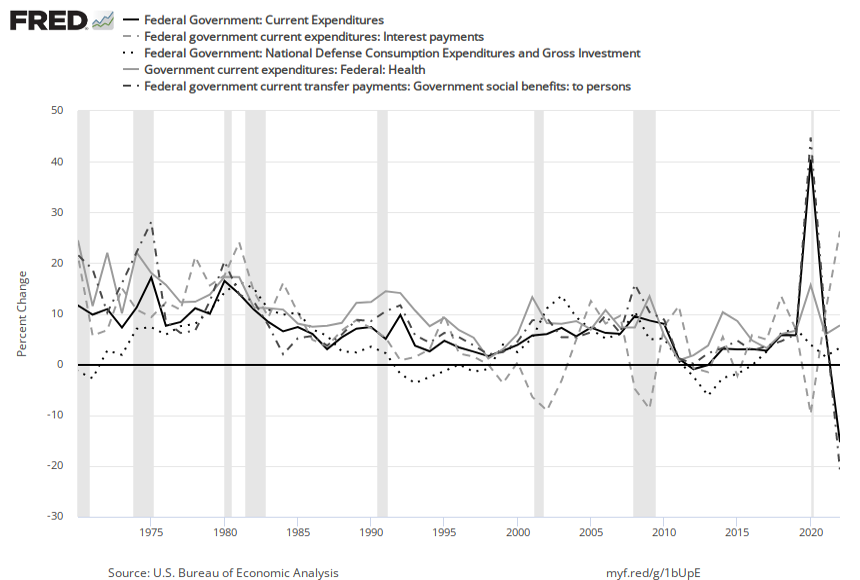

The top line in Figure 1 shows the federal spending level since 1960, expressed as a share of GDP. Despite a widespread sense among many Americans that the federal government has been growing steadily larger, the graph shows that federal spending has hovered in a range from 18% to 22% of GDP most of the time since 1960. The other lines in Figure 1 show the major federal spending categories: national defense, Social Security, health programs, and interest payments. From the graph, we see that national defense spending as a share of GDP has generally declined since the 1960s, although there were some upward bumps in the 1980s buildup under President Ronald Reagan and in the aftermath of the terrorist attacks on September 11, 2001. In contrast, Social Security and healthcare have grown steadily as a percent of GDP. Healthcare expenditures include both payments for senior citizens (Medicare), and payments for low-income Americans (Medicaid). State governments also partially fund Medicaid. Interest payments are the final main category of government spending in Figure 1.

Figure 1. Change in Federal Spending, 1970–present. Since 1970, total federal spending has ranged from about 18% to 22% of GDP, although it climbed above that level in 2009 and again during the COVID-19 pandemic. The share that the government has spent on national defense has generally declined, while the share it has spent on Social Security and on healthcare expenses (mainly Medicare and Medicaid) has increased.

Each year, the government borrows funds from U.S. citizens and foreigners to cover its budget deficits. It does this by selling securities (Treasury bonds, notes, and bills)—in essence borrowing from the public and promising to repay with interest in the future. From 1961 to 1997, the U.S. government has run budget deficits, and thus borrowed funds, in almost every year. It had budget surpluses from 1998 to 2001, and then returned to deficits.

The interest payments on past federal government borrowing were typically 1–2% of GDP in the 1960s and 1970s but then climbed above 3% of GDP in the 1980s and stayed there until the late 1990s. The government was able to repay some of its past borrowing by running surpluses from 1998 to 2001 and, with help from low interest rates, the interest payments on past federal government borrowing had fallen back to 1.4% of GDP by 2012.

We investigate the government borrowing and debt patterns in more detail later in this chapter, but first we need to clarify the difference between the deficit and the debt. The deficit is not the debt. The difference between the deficit and the debt lies in the time frame. The government deficit (or surplus) refers to what happens with the federal government budget each year. The government debt is accumulated over time. It is the sum of all past deficits and surpluses. If you borrow $10,000 per year for each of the four years of college, you might say that your annual deficit was $10,000, but your accumulated debt over the four years is $40,000.

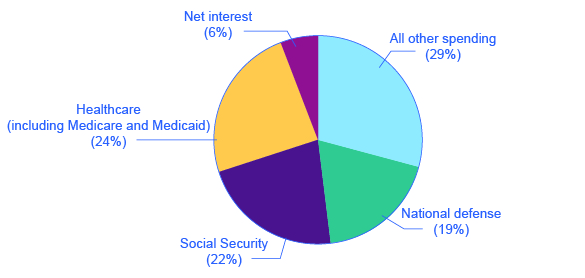

These four categories—national defense, Social Security, healthcare, and interest payments—account for roughly 73% of all federal spending, as Figure 2 shows. The remaining 27% wedge of the pie chart covers all other categories of federal government spending: international affairs; science and technology; natural resources and the environment; transportation; housing; education; income support for the poor; community and regional development; law enforcement and the judicial system; and the administrative costs of running the government.

State and Local Government Spending

Although federal government spending often gets most of the media attention, state and local government spending is also substantial—at about $3.1 trillion in 2014. Figure 3 shows that state and local government spending has increased during the last four decades from around 8% to around 14% today. The single biggest item is education, which accounts for about one-third of the total. The rest covers programs like highways, libraries, hospitals and healthcare, parks, and police and fire protection. Unlike the federal government, all states (except Vermont) have balanced budget laws, which means any gaps between revenues and spending must be closed by higher taxes, lower spending, drawing down their previous savings, or some combination of all of these.

U.S. presidential candidates often run for office pledging to improve the public schools or to get tough on crime. However, in the U.S. government system, these tasks are primarily state and local government responsibilities. In fiscal year 2014 state and local governments spent about $840 billion per year on education (including K–12 and college and university education), compared to only $100 billion by the federal government, according to usgovernmentspending.com. In other words, about 90 cents of every dollar spent on education happens at the state and local level. A politician who really wants hands-on responsibility for reforming education or reducing crime might do better to run for mayor of a large city or for state governor rather than for president of the United States.

Summary

Fiscal policy is the set of policies that relate to federal government spending, taxation, and borrowing. In recent decades, the level of federal government spending and taxes, expressed as a share of GDP, has not changed much, typically fluctuating between about 18% to 22% of GDP. However, the level of state spending and taxes, as a share of GDP, has risen from about 12–13% to about 20% of GDP over the last four decades. The four main areas of federal spending are national defense, Social Security, healthcare, and interest payments, which together account for about 70% of all federal spending. When a government spends more than it collects in taxes, it is said to have a budget deficit. When a government collects more in taxes than it spends, it is said to have a budget surplus. If government spending and taxes are equal, it is said to have a balanced budget. The sum of all past deficits and surpluses makes up the government debt.

References

Kramer, Mattea, et. al. A People’s Guide to the Federal Budget. National Priorities Project. Northampton: Interlink Books, 2012.

Kurtzleben, Danielle. “10 States With The Largest Budget Shortfalls.” U.S. News & World Report. Januray 14, 2011. http://www.usnews.com/news/articles/2011/01/14/10-states-with-the-largest-budget-shortfalls.

Miller, Rich, and William Selway. “U.S. Cities and States Start Spending Again.” BloombergBusinessweek, January 10, 2013. http://www.businessweek.com/articles/2013-01-10/u-dot-s-dot-cities-and-states-start-spending-again.

Weisman, Jonathan. “After Year of Working Around Federal Cuts, Agencies Face Fewer Options.” The New York Times, October 26, 2013. http://www.nytimes.com/2013/10/27/us/politics/after-year-of-working-around-federal-cuts-agencies-face-fewer-options.html?_r=0.

Chantrill, Christopher. USGovernmentSpending.com. “Government Spending Details: United States Federal State and Local Government Spending, Fiscal Year 2013.” http://www.usgovernmentspending.com/year_spending_2013USbn_15bs2n_20.

Glossary

- balanced budget

- when government spending and taxes are equal

- budget deficit

- when the federal government spends more money than it receives in taxes in a given year

- budget surplus

- when the government receives more money in taxes than it spends in a year

when the federal government spends more money than it receives in taxes in a given year

when the government receives more money in taxes than it spends in a year

when government spending and taxes are equal