8.5 – The Confusion Over Inflation

Learning Objectives

By the end of this section, you will be able to:

- Explain how inflation can cause redistributions of purchasing power

- Identify ways inflation can blur the perception of supply and demand

- Explain the economic benefits and challenges of inflation

Economists usually oppose high inflation, but they oppose it in a milder way than many non-economists. Robert Shiller, one of 2013’s Nobel Prize winners in economics, carried out several surveys during the 1990s about attitudes toward inflation. One of his questions asked, “Do you agree that preventing high inflation is an important national priority, as important as preventing drug abuse or preventing deterioration in the quality of our schools?” Answers were on a scale of 1–5, where 1 meant “Fully agree” and 5 meant “Completely disagree.” For the U.S. population as a whole, 52% answered “Fully agree” that preventing high inflation was a highly important national priority and just 4% said “Completely disagree.” However, among professional economists, only 18% answered “Fully agree,” while the same percentage of 18% answered “Completely disagree.”

The Land of Funny Money

What are the economic problems caused by inflation, and why do economists often regard them with less concern than the general public? Consider a very short story: “The Land of Funny Money.”

One morning, everyone in the Land of Funny Money awakened to find that everything denominated in money had increased by 20%. The change was completely unexpected. Every price in every store was 20% higher. Paychecks were 20% higher. Interest rates were 20 % higher. The amount of money, everywhere from wallets to savings accounts, was 20% larger. This overnight inflation of prices made newspaper headlines everywhere in the Land of Funny Money. However, the headlines quickly disappeared, as people realized that in terms of what they could actually buy with their incomes, this inflation had no economic impact. Everyone’s pay could still buy exactly the same set of goods as it did before. Everyone’s savings were still sufficient to buy exactly the same car, vacation, or retirement that they could have bought before. Equal levels of inflation in all wages and prices ended up not mattering much at all.

When the people in Robert Shiller’s surveys explained their concern about inflation, one typical reason was that they feared that as prices rose, they would not be able to afford to buy as much. In other words, people were worried because they did not live in a place like the Land of Funny Money, where all prices and wages rose simultaneously. Instead, people live here on Planet Earth, where prices might rise while wages do not rise at all, or where wages rise more slowly than prices.

Some economists argue that over most periods, the inflation level in prices is roughly similar to the inflation level in wages, and so, on average, over time, people’s economic status is not greatly changed by inflation. If all prices, wages, and interest rates adjusted automatically and immediately with inflation, as in the Land of Funny Money, then no one’s purchasing power, profits, or real loan payments would change. However, if other economic variables do not move exactly in sync with inflation, or if they adjust for inflation only after a time lag, then inflation can cause three types of problems: unintended redistributions of purchasing power, blurred price signals, and difficulties in long-term planning.

Unintended Redistributions of Purchasing Power

Inflation can cause redistributions of purchasing power that hurt some and help others. People who are hurt by inflation include those who are holding considerable cash, whether it is in a safe deposit box or in a cardboard box under the bed. When inflation happens, the buying power of cash diminishes. However, cash is only an example of a more general problem: anyone who has financial assets invested in a way that the nominal return does not keep up with inflation will tend to suffer from inflation. For example, if a person has money in a bank account that pays 4% interest, but inflation rises to 5%, then the real rate of return for the money invested in that bank account is negative 1%.

The problem of a good-looking nominal interest rate transforming into an ugly-looking real interest rate can be worsened by taxes. The U.S. income tax is charged on the nominal interest received in dollar terms, without an adjustment for inflation. Thus, the government taxes a person who invests $10,000 and receives a 5% nominal rate of interest on the $500 received—no matter whether the inflation rate is 0%, 5%, or 10%. If inflation is 0%, then the real interest rate is 5% and all $500 is a gain in buying power. However, if inflation is 5%, then the real interest rate is zero and the person had no real gain—but owes income tax on the nominal gain anyway. If inflation is 10%, then the real interest rate is negative 5% and the person is actually falling behind in buying power, but would still owe taxes on the $500 in nominal gains. Of course, taxes are applied to the nominal value of all incomes, not just interest, so the essence of this argument applies to wages and salaries as well. Indeed, depending on the structure of the financial investments involved, individuals earning their income this way may be subject to a lower tax rate than those who collect salaries or wages.

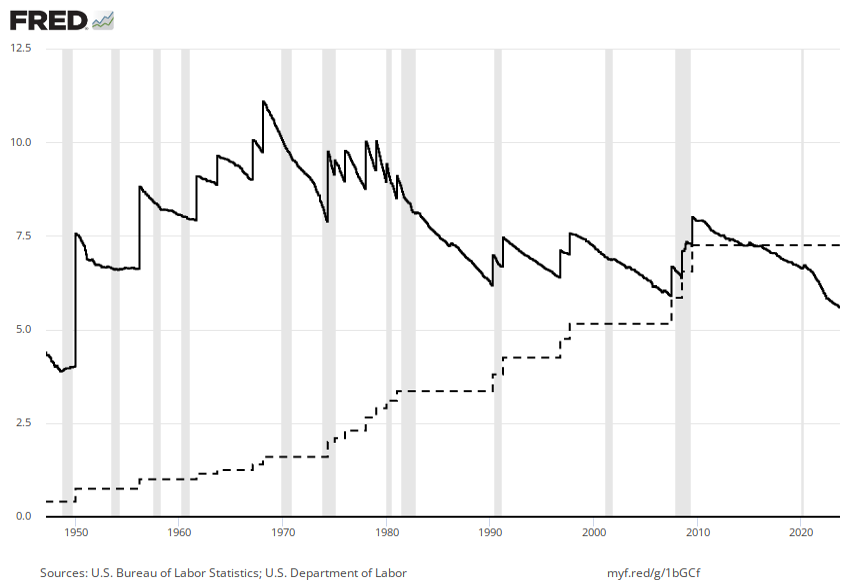

Inflation can cause unintended redistributions for wage earners, too. Wages do typically creep up with inflation over time, eventually. The second-to-last row of Table 1 at the start of this chapter showed that the average hourly wage of nonmanagerial workers in the goods sector increased from $6.85 in 1980 to $27.56 in 2022, which is an increase by a factor of more than four. Over that time period, however, the Consumer Price Index increased by nearly as much. However, increases in wages may lag behind inflation for a year or two, since wage adjustments are often somewhat sticky and occur only once or twice a year. Moreover, the extent to which wages keep up with inflation creates insecurity for workers and may involve painful, prolonged conflicts between employers and employees. If the government adjusts minimum wage for inflation only infrequently, minimum wage workers are losing purchasing power from their nominal wages, as Figure 1 shows.

Figure 1. U.S. Minimum Wage and Inflation. After adjusting for inflation, the real federal minimum wage (solid line, in 2015 dollars) fell by half from 1968 to 2023, even though the nominal figure (dashed line) climbed from $1.40 to $7.25 per hour. Increases in the minimum wage in between 2008 and 2010 kept the decline from being worse than it would have been if the wage had remained the same as it did from 1997 through 2007. Since 2010, the real minimum wage has continued to decline.

One sizable group of people has often received a large share of their income in a form that does not increase over time: retirees who receive a private company pension. Most pensions have traditionally been set as a fixed nominal dollar amount per year at retirement. For this reason, economists call pensions “defined benefits” plans. Even if inflation is low, the combination of inflation and a fixed income can create a substantial problem over time. A person who retires on a fixed income at age 65 will find that losing just 1% to 2% of buying power per year to inflation compounds to a considerable loss of buying power after a decade or two.

Fortunately, pensions and other defined benefits retirement plans are increasingly rare, replaced instead by “defined contribution” plans, such as 401(k)s and 403(b)s. In these plans, the employer contributes a fixed amount to the worker’s retirement account on a regular basis (usually every pay check). The employee often contributes as well. The worker invests these funds in a wide range of investment vehicles. These plans are tax deferred, and they are portable so that if the individual takes a job with a different employer, their 401(k) comes with them. To the extent that the investments made generate real rates of return, retirees do not suffer from the inflation costs of traditional pensioners.

However, ordinary people can sometimes benefit from the unintended redistributions of inflation. Consider someone who borrows $10,000 to buy a car at a fixed interest rate of 9%. If inflation is 3% at the time the loan is made, then he or she must repay the loan at a real interest rate of 6%. However, if inflation rises to 9%, then the real interest rate on the loan is zero. In this case, the borrower’s benefit from inflation is the lender’s loss. A borrower paying a fixed interest rate, who benefits from inflation, is just the flip side of an investor receiving a fixed interest rate, who suffers from inflation. The lesson is that when interest rates are fixed, rises in the rate of inflation tend to penalize suppliers of financial capital, who receive repayment in dollars that are worth less because of inflation, while demanders of financial capital end up better off, because they can repay their loans in dollars that are worth less than originally expected.

The unintended redistributions of buying power that inflation causes may have a broader effect on society. America’s widespread acceptance of market forces rests on a perception that people’s actions have a reasonable connection to market outcomes. When inflation causes a retiree who built up a pension or invested at a fixed interest rate to suffer, however, while someone who borrowed at a fixed interest rate benefits from inflation, it is hard to believe that this outcome was deserved in any way. Similarly, when homeowners benefit from inflation because the price of their homes rises, while renters suffer because they are paying higher rent, it is hard to see any useful incentive effects. One of the reasons that the general public dislikes inflation is a sense that it makes economic rewards and penalties more arbitrary—and therefore likely to be perceived as unfair—even dangerous, as the next Clear It Up feature shows.

Is there a connection between German hyperinflation and Hitler’s rise to power?

Germany suffered an intense hyperinflation of its currency, the Mark, in the years after World War I, when the Weimar Republic in Germany resorted to printing money to pay its bills and the onset of the Great Depression created the social turmoil that Adolf Hitler was able to take advantage of in his rise to power. Shiller described the connection this way in a National Bureau of Economic Research 1996 Working Paper:

A fact that is probably little known to young people today, even in Germany, is that the final collapse of the Mark in 1923, the time when the Mark’s inflation reached astronomical levels (inflation of 35,974.9% in November 1923 alone, for an annual rate that month of 4.69 × 1028%), came in the same month as did Hitler’s Beer Hall Putsch, his Nazi Party’s armed attempt to overthrow the German government. This failed putsch resulted in Hitler’s imprisonment, at which time he wrote his book Mein Kampf, setting forth an inspirational plan for Germany’s future, suggesting plans for world domination. . .

. . . Most people in Germany today probably do not clearly remember these events; this lack of attention to it may be because its memory is blurred by the more dramatic events that succeeded it (the Nazi seizure of power and World War II). However, to someone living through these historical events in sequence . . . [the putsch] may have been remembered as vivid evidence of the potential effects of inflation.

Blurred Price Signals

From the perspective of orthodox economics, prices are the messengers in a market economy, conveying information about conditions of demand and supply. From a heterodox perspective, prices are one of the tools with which businesses ensure their long-term survival through planning. But no matter how you look at it, inflation disrupts the function of prices—blurring the price messages for the orthodox economists, or upsetting the planning processes of businesses for the heterodox economists. Inflation means that we perceive price signals more vaguely and have less certainty about what things will cost and whether operations will be profitable. It’s a bit like a radio program received with considerable static. If the static becomes severe, it is hard to tell what is happening.

In Israel, when inflation accelerated to an annual rate of 500% in 1985, some stores stopped posting prices directly on items, since they would have had to put new labels on the items or shelves every few days to reflect inflation. Instead, a shopper just took items from a shelf and went up to the checkout register to find out the price for that day. Obviously, this situation makes comparing prices and shopping for the best deal rather difficult. When the levels and changes of prices become uncertain, businesses and individuals find it harder to react to economic signals. In a world where inflation is at a high rate, but bouncing up and down to some extent, does a higher price of a good mean that inflation has risen, or that supply of that good has decreased, or that demand for that good has increased? Should a buyer of the good take the higher prices as an economic hint to start substituting other products—or have the prices of the substitutes risen by an equal amount? Should a seller of the good take a higher price as a reason to increase production—or is the higher price only a sign of a general inflation in which the prices of all inputs to production are rising as well? The true story will presumably become clear over time, but at a given moment, who can say?

Problems of Long-Term Planning

Inflation can make long-term planning difficult. In discussing unintended redistributions, we considered the case of someone trying to plan for retirement with a pension that is fixed in nominal terms and a high rate of inflation. Similar problems arise for all people trying to save for retirement, because they must consider what their money will really buy several decades in the future when we cannot know the rate of future inflation.

Inflation, especially at moderate or high levels, will pose substantial planning problems for businesses, too. A firm can make money from inflation—for example, by paying bills and wages as late as possible so that it can pay in inflated dollars, while collecting revenues as soon as possible. A firm can also suffer losses from inflation, as in the case of a retail business that gets stuck holding too much cash, only to see inflation eroding the value of that cash. However, when a business spends its time focusing on how to profit by inflation, or at least how to avoid suffering from it, an inevitable tradeoff strikes: less time is spent on improving products and services or on figuring out how to make existing products and services more cheaply. An economy with high inflation rewards businesses that have found clever ways of profiting from inflation, which are not necessarily the businesses that excel at productivity, innovation, or quality of service.

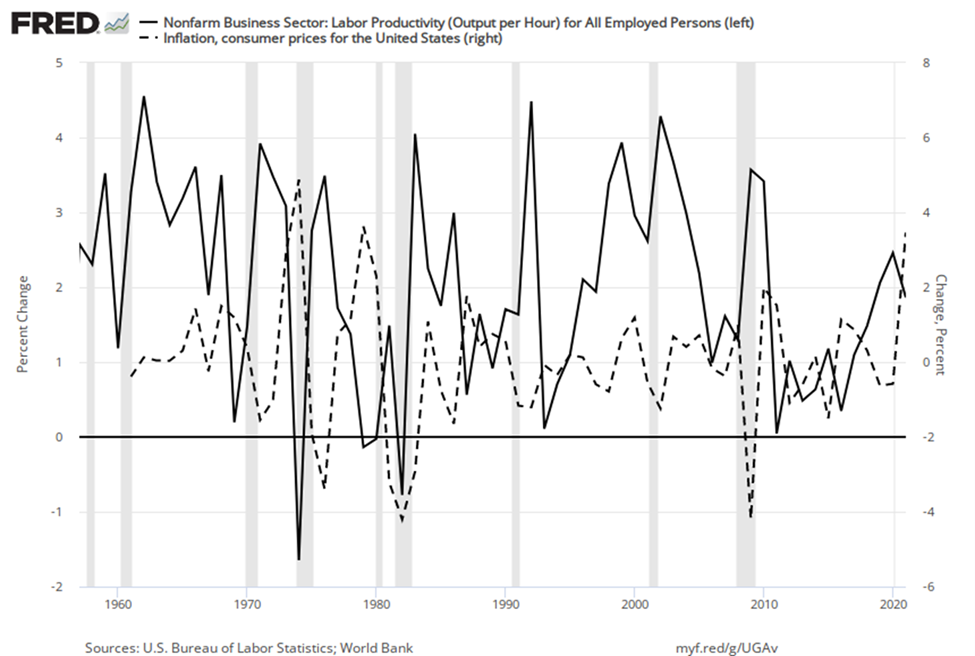

In the short term, low or moderate levels of inflation may not pose an overwhelming difficulty for business planning, because costs of doing business and sales revenues may rise at similar rates. If, however, inflation varies substantially over the short or medium term, then it may make sense for businesses to stick to shorter-term strategies. The evidence as to whether relatively low rates of inflation reduce productivity is controversial among economists. There is some evidence that if inflation can be held to moderate levels of less than 3% per year, it need not prevent a nation’s real economy from growing at a healthy pace. For some countries that have experienced hyperinflation of several thousand percent per year, an annual inflation rate of 20–30% may feel basically the same as zero. However, several economists have pointed to the suggestive fact that when U.S. inflation heated up in the early 1970s—to 10%—U.S. growth in productivity slowed down, and when inflation slowed down in the 1980s, productivity edged up again not long thereafter, as Figure 2 shows.

Figure 2. U.S. Inflation Rate and U.S. Labor Productivity, 1961–2014. Over the last several decades in the United States, there have been times when rising inflation rates have been closely followed by lower productivity rates and lower inflation rates have corresponded to increasing productivity rates. As the graph shows, however, this correlation does not always exist.

Any Benefits of Inflation?

Although the economic effects of inflation are primarily negative, two countervailing points are worth noting. First, the impact of inflation will differ considerably according to whether it is creeping up slowly at 0% to 2% per year, galloping along at 10% to 20% per year, or racing to the point of hyperinflation at, say, 40% per month. Hyperinflation can rip an economy and a society apart. An annual inflation rate of 2%, 3%, or 4%, however, is a long way from a national crisis. Low inflation is also better than deflation which can occur in severe recessions.

Second, some orthodox economists argue that moderate inflation may help the economy by making wages in labor markets more flexible. The discussion in Unemployment pointed out that wages tend to be sticky in their downward movements and that unemployment can result. A little inflation could nibble away at real wages, and thus help real wages to decline if necessary. In this way, even if a moderate or high rate of inflation may act as sand in the gears of the economy, perhaps a low rate of inflation serves as oil for the gears of the labor market. This argument is controversial, with heterodox economists arguing that declining real wages would likely make business sales and unemployment worse. You’ll learn about these different views in later chapters. For now, it is reasonable to conclude that, all things considered, very low rates of inflation may not be especially harmful.

Summary

Unexpected inflation will tend to hurt those whose money received, in terms of wages and interest payments, does not rise with inflation. In contrast, inflation can help those who owe money that they can pay in less valuable, inflated dollars. Low rates of inflation have relatively little economic impact over the short term. Over the medium and the long term, even low rates of inflation can complicate future planning. High rates of inflation can muddle price signals in the short term and prevent market forces from operating efficiently, and can vastly complicate long-term savings and investment decisions.

References

Shiller, Robert. “Why Do People Dislike Inflation?” NBER Working Paper Series, National Bureau of Economic Research, p. 52. 1996.

an economy where economic decisions are decentralized, resources are owned by private individuals, and businesses supply goods and services based on demand

the market in which households sell their labor as workers to business firms or other employers